In Clark County, Nevada, small businesses have chances to grow through special programs. To start your business here, you need a Clark County business license. It helps you run your business the right way.

Introduction:

Starting a small business or launching a startup with a Clark County business license opens up lots of opportunities in a business-friendly place. Clark County is the main hub for the economy in Southern Nevada, especially known for the business area on the Las Vegas Strip.

The main forces driving the county’s economy are gaming and tourism. Some big companies in Clark County are MGM Grand Las Vegas, Bellagio, Southwest Airlines, The Mirage, University Medical Center of Southern Nevada, The Cosmopolitan of Las Vegas, and Nellis Air Force Base.

Business in Clark County

In Clark County, everyone from home businesses to small ones in commercial spaces needs a license. The county’s economy depends on businesses in places like Las Vegas Valley, including Henderson, North Las Vegas, and Paradise. Clark County has over 56,000 businesses, and 86% have less than 20 workers.

Since 2010, about 7,600 new businesses formed, with 5,540 being small ones, says a U.S. Department of Commerce report. This shows more small businesses started after getting a Clark County license. The good news is that both small and big businesses in Clark County benefit from Nevada’s economic success. Notably, large businesses are major customers for the goods and services offered by small businesses, creating a strong business environment.

Getting Your Clark County Business License and Permits

Starting a new business in Clark County is a smart choice, considering the many advantages it offers. The benefits include support programs from the state and county that help small businesses grow, along with different business incentives.

To get your business up and running, there are specific rules you need to follow, like obtaining a Clark County business license. Let’s go through the necessary steps for getting your license and permits.

1. Start a company (LLC/Corporation).

What kind of business do you want in Clark County, Nevada? You can choose between a Limited Liability Company and Private Corporations. The steps to start your business depend on the type you pick, and both need a Clark County business license.

For a business corporation, you need to file Articles of Incorporation, and for a Limited Liability Company, it’s Articles of Organization. You can file these documents with the Nevada Secretary of State’s office or get them from IncParadise.

We offer extra services to help you meet all the requirements for starting a business. Partnering with experienced companies like IncParadise ensures everything is in order.

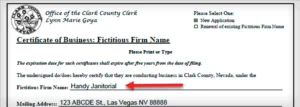

2. Get a Made-Up Name Certificate (DBA)

A DBA, or ‘Doing Business As,’ is like a nickname for a business. It’s also called a Fictitious Business Name. When you want to use a different name for your business, even if you already have a company, you need to file a DBA. This filing tells the public who really owns the business. To get a Clark County business license in Nevada, you must follow the rules in NV Rev Stat § 602.020 (2017). Applying for a DBA is essential, and you’ll need to show a certificate with the new name when getting your license.

3. Get a License for Your Business in the State.

To get a Clark County business license, a business must first get a state business license. All Title 7 businesses (like LLCs and corporations) must apply for a state business license according to Chapter 76 of the 2015 Nevada Revised Statutes. At IncParadise, we include getting a state business license as part of your business registration. This ensures you meet all the necessary requirements, making the business formation process quick and compliant with state rules.

4. Get a license to sell things in a store (if needed).

In Clark County, if a business wants to buy things to sell again, they don’t have to pay sales tax. They just need to give a Nevada Resale Certificate to their sellers. But, before that, they must get a Nevada Seller’s Permit from the Nevada Department of Taxation. This rule applies only to businesses planning to buy and sell things, not all businesses with a Clark County license.

5. Obtain a license in your area.

Once you get your state business permit and meet state rules, you can apply for a local license in Clark County. The kind of license and the cost depend on your business type. For instance, if you have amusement machines, you’ll need an Arts, Entertainment, Recreation – Group 4 license, costing $35 per player station, pool table, or jukebox.

For a bakery, it falls under ‘Other Manufacturing’ and requires a fee based on its earnings. Some companies might require more than one license. Remember, filing for a Clark County business license costs $45.00 as a non-refundable application fee, in addition to the business license fee.

6. Get the required permits for the environment.

In Clark County, it’s important to check if your business needs a special permit to operate. The permit depends on what your business does and is given by the Nevada Division of Environmental Protection (NDEP). If your business deals with things like wastewater, air pollutants, solid waste, or hazardous materials, you’ll need to get an environmental permit. Some businesses need one permit, some need more, and some don’t need any.

7. Get special permits if needed.

To start your business in Clark County, you need more than just a business license. You might also need special permits, like a ‘Fire Prevention permit’ for places like restaurants and bars. There are also permits for temporary events called Special Events Permits, and Temporary Use Structure Building Permits. These permits can be obtained from the Clark County Department of Building & Fire Prevention.

Can you Advertised by Incparadise?

Clark County, Nevada is a great place to start a small business. IncParadise can assist new businesses with registering and getting the needed paperwork, like the Clark County business license, to kickstart operations. We offer various business services that can benefit you.

● Our skilled team at IncParadise is here to help your business. We know every business has different goals. To achieve them, you may need support with things like starting your business and getting licenses. That’s where we come in! Our experienced team can assist with business formation, state, and local licenses. If you have questions about starting a business in Nevada, we’ve got you covered.

● For Nevada businesses, starting your business is just the beginning. There are many rules to follow to keep your business running smoothly. IncParadise offers extra services to make sure your business stays compliant with Nevada laws. In addition to helping with Clark County business licenses, we also offer services like filing annual reports, mail forwarding, applying for a Nevada Tax ID, virtual office services, and more.

No Comments